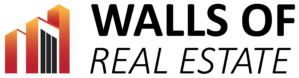

The January data of the Canada real estate market shows the reports of the consecutive months of residential translation’s increasing numbers. But after that, some of the following data show a little probability of a Canada real estate crash. The uptick of earlier results from local estate shows the boards from all types of despairing levels in most cases. It also suggests the downturns which started in the Spring of 2022 and also runs its courses.

The interest rates drop for fixed-rate mortgages since November actually cracked the door and opened for new buyers. This growing expectation of the Bank of Canada of the next move rated cut with low confidence. Many researchers and analysts keep thinking the supported healing won’t take any form before interest rates drop which we can expect from the second half of 2024.

The sharp loss of affordability from the pandemic continues to weigh canadian property values. The MLA home price indexing generally fell for the month over the months again from January. Calgary remains an exceptional where the price maintains an upward trajectory. The latest real estate housing market is forecasting an annual price that will fall 1% in 2024 right before a rise of 3.1% in the next year the price projects to rise 2.2% in Alberta and experience a 2.0% fall in Ontario.

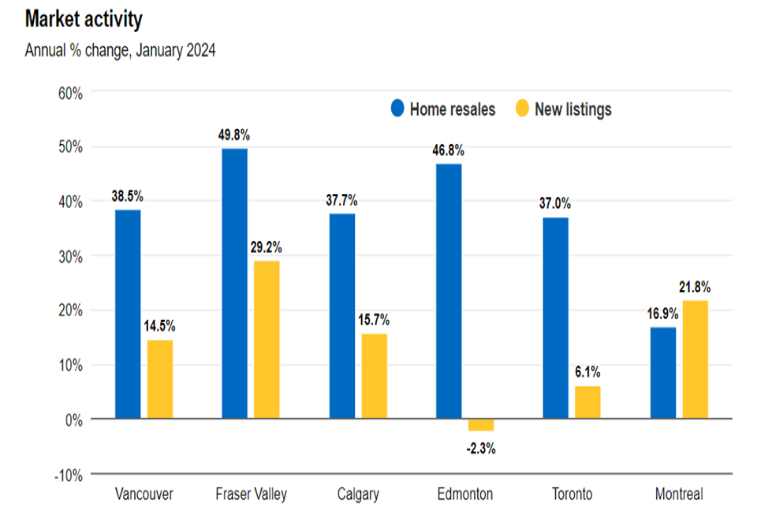

Is The Toronto Area Turning In A Corner?

The pace of residential transactions has picked up in the past couple of months. The recent Canada real estate crash prices and drops in fixed mortgage rates are just what some of the buyers are waiting for seal and deal.

Unusual mild weather is putting them in a spring-like festive mood. The back-to-back rises of the home resealed include a 9.6% m/m increase from January. The mild weather puts them in a spring upbeat mood.

Stretched affordable conditions keep the potential buyers on the sidelines till the interest rates and the property values fall. The analyst also analyzes they are letting the windows open for the second half of this year.

The MLS HPI facilitated 1.2% m/m in January making it the sixth consecutive month. Since January the total price reduction is 7.2% and $84,000. This trend may not persist much longer whether the recent tightening works on-demand supply conditions that are sustained. The analysts expect the price will reach the bottom and spring and recover over the second half of 2024.

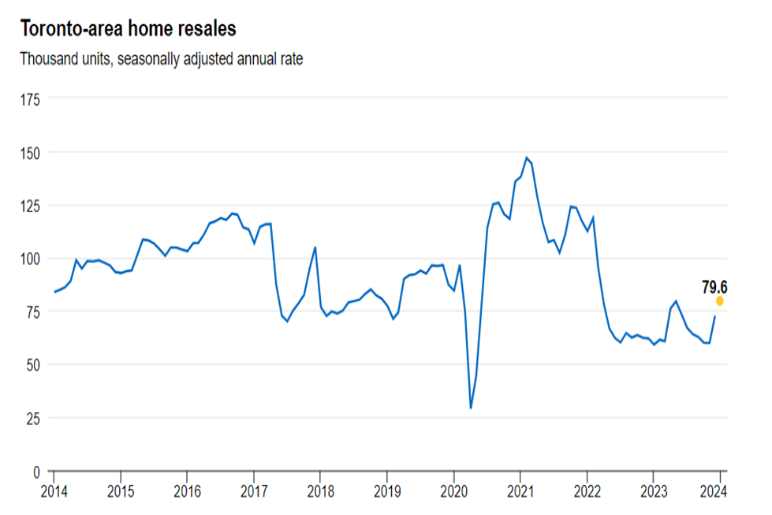

What Is Montreal Area’s Holding Pattern?

The Canada real estate crash started in 2024 almost in the same way as it ended in 2023. This is a holding pattern by which home resales were in the little changes for the last few months. So we are in a balance between supply and demand.

The overall tone is calm from this stage and translation activities are working modestly which is above the cyclical low point reached in early 2023. It will also going to be more convincing for the buyers.

The soft provisional economy has increased the labor relations tensions of late. The lower interest rates choice ultimately helps you but that’s more likely to tell the story for the second half of 2024. The expectations are to keep the home prices flat till the end of summer.

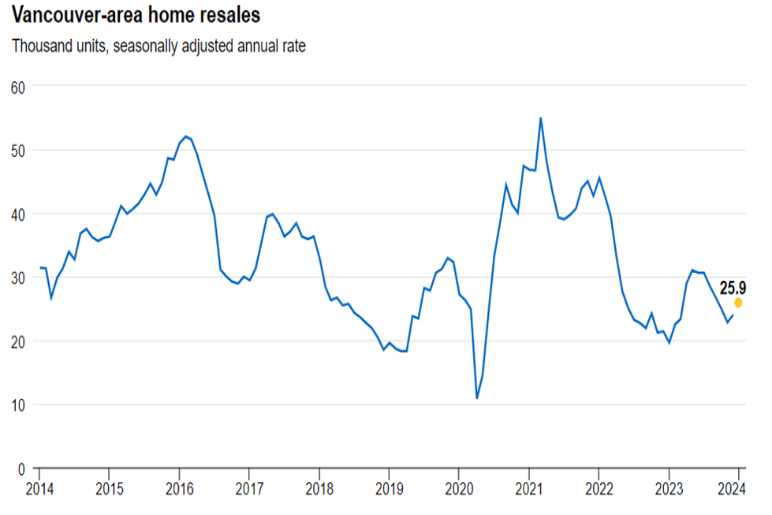

What Will Happen To The Vancouver Area?

Buyers and sellers are going to be much busier from January 2024. The Canada real estate crash report analysis shows a growth of 8% m/m after the seasonal adjustments. This is a possible sign of the market which is on the work and will take more time to return to the pre-pandemic levels.

These recent drops show the records of the fixed mortgage rates which can motivate the buyers to make a move. Still, now the market expects to have higher numbers of resellers who like to enter the market.

The new listing can be jumped into 15% m/m and can increase purchasing opportunities. The demand-supply conditions are softened as a result. The MLS HPI can now be down by some $47,000 less than 4% from the past four months. We also think there is room for further easing. Vancouver buyers can have the challenges for the worst affordability conditions in Canada. This will also likely continue the weight based on the prices.

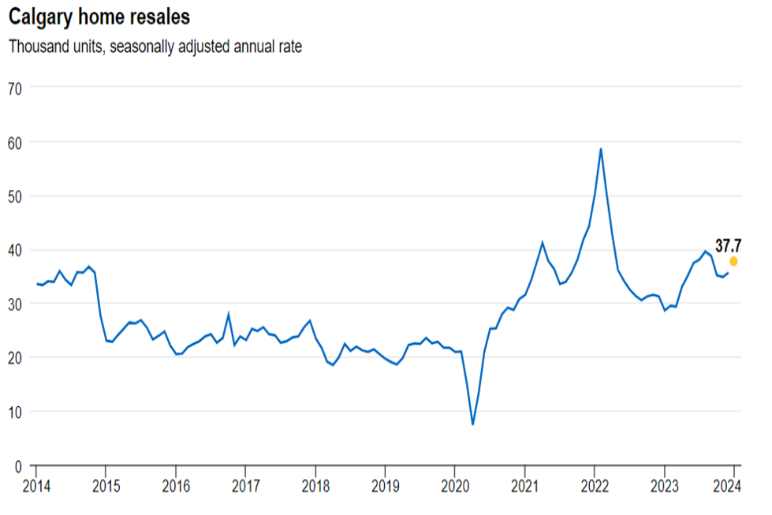

Does Canada’s Housing Hotspot Also Faces The Same Challenges?

Does Canada real estate crash also affect Calgary the main housing Hubspot? Calgary also going to maintain its status. The solid sales results from January lifted the activities to almost more than 80% pre-pandemic levels.

The demand and supply conditions are working by the far and tightening up the country. The inventories also continue to lower the trends. The MLS HPI from January was up almost 10% higher than a year ago. These evaluation rates are cut off by the Bank Of Canada which keeps in the wind in the Calgary sail.

Bottomline

When it comes to improving the housing market or the effects of the Canada Real Estate Crash. The best solution is to maintain the practical approach while making any decision. The housing community of local councilors or the MPP. The housing crash of Canada would like to bring affordability back to the market and it is something that should be rooted.

Also Read:-

- 10 Best Shower Standing Handles

- What Are The Disadvantages Of Seller Paying Closing Costs?

- What Is A Risk Management Strategy You Could Use To Protect Your Home?

Feature image source:- https://tinyurl.com/2whwvtds